#1 Ranked Business Brokers for these Industries

If you are considering selling a company, you want your M&A firm or Business Brokerage firm to have experience in your industry. Quicksprout (a well-regarded business advisory site) has ranked Synergy Business Brokers as the #1 Brokerage for the industries that we specialize in below. There are several advantages that an advisory firm with industry experience can provide, including:

- Relationships with buyers within the industry or related industries

- The ability to emphasize the strengths of your business as it relates to the industry

- Experience in writing marketing documents for companies in your industry

- Understanding the language of the sector

In this article, we will discuss some of the areas below in which Synergy Business Brokers has had experience selling companies and in which we have developed a relationship with buyers within these industries. Feel free to skip ahead to a sector that is of interest following the overview. The industries appear in the article in the order below:

Selling your Company to a buyer within your industry vs. Selling outside your industry

When selling a business within a given industry, we recommend keeping an open mind. In some cases, the best offer comes from someone within the industry, and in some cases, the best offer comes from someone outside the industry.

In addition to price and terms, there are other factors to consider when selling to a buyer within your industry or outside your industry. Some sellers are concerned about selling to a direct competitor. They may not want to sell to specific competitors and may be open to selling to others.

Confidentiality is essential when selling to any buyer. Still, when discussing your business's sale with a direct competitor, you have to be extra cautious about releasing confidential information at the right time in the sales process. You want to make sure you have the proper protections in place if a deal is not closed.

Sometimes, other companies in related industries or different sub-industries can leverage your expertise better than a direct competitor. They may need your knowledge within the industry and may be willing to pay more for that than a company within the industry with this knowledge. An example would be a software company that wants to expand into providing IT Services. Your employees' and customers' value within the services industry may be precious in gaining traction within this new segment.

Now that we've given you an overview of some of the factors that go into selling to an industry buyer or outside the industry, it's time to discuss some of our experiences within each sector.

- Technology

- Healthcare

- Manufacturing

- Construction

- Wholesale/Distribution

- Services

- Transportation

- Contractors

- Engineering

- Education

Technology

Almost half of our staff have worked in the technology industry, so we understand the industry well. Some of our staff's previous experiences within the tech industry are as follows:

- VP of Sales & Marketing for a Software company. Grew the business over 2,000%, resulting in the sale of the company for $20 Million.

- VP of Technology for Bank Of America/Merrill Lynch. Reported to the Chief Operating Officer.

- Director of Sales of a High Growth IT Services Company.

- National Account Manager of a Value Added Reseller

- Senior Sales Positions at Fortune 500 Tech Companies

Our prior work experience within the industry has allowed us to sell technology companies at Synergy Business Brokers for over 15 years. We have built up a vast database of technology companies that we have relationships with from doing many M&A deals within the tech industry. Within the tech industry, we have sold:

- Software Companies

- IT Services Companies

- Value Added Resellers (VARs)

- Internet Companies

- Hardware Manufacturing Companies

- Wireless Technology Companies

- Infrastructure Companies

- eCommerce Companies

If you are interested in buying a tech company, you can view our Tech Companies for Sale.

Here are two examples of deals that we've done:

- We sold an Electronic Healthcare Records (EHR) Software Company in New York to a Value Added Reseller located in Canada. The owner of the VAR wanted to diversify because his business had a very high net income. However, 98% of his business was tied up in one customer. If he lost that customer, he would no longer have much of a company left. He had access to financing with his local bank in Canada and outbid a private equity firm, a software company located in Europe, and a Silicon Valley tech company. Since his initial acquisition of the EHR software company, he has purchased several additional healthcare software companies to gain synergies within the space.

- We sold a value-added reseller with a specialization in the education market to a tech entrepreneur. The buyer had built up vast experience within the corporate technology industry and had amassed significant funds for an acquisition. His bid was higher than that of other technology firms within the industry, and he did not require any bank financing, so he was able to move quickly.

For more deals that we have closed, you can visit our Sold Businesses page. As you can see from the previous examples, many industries crossover, such as a healthcare software company and an education tech company. The next industry we will cover is healthcare.

Healthcare

We have been selling Healthcare businesses for many years. There is no shortage of potential buyers for healthcare companies. The issue is finding the right buyer for the right business at a price that works for both parties. We sell profitable companies with an owner's annual net income of $250,000 to $7 Million+. We have potential buyers for the following types of healthcare companies:

- Pharmaceuticals

- Home Healthcare

- Medical

- Mental & Behavioral Health

- Physical & Occupational Therapy

- Medical Equipment

- Medical Supplies

- Medical Transportation

- Medical Devices

If you would like to acquire a Healthcare company, please view our: Health Care Companies for Sale.

Buyers for healthcare businesses can vary from private equity firms, other healthcare companies, companies in related companies, or private investors. Below are two examples of healthcare businesses we sold:

- Home Healthcare Business in Connecticut. The owner was in their 60s and had built up a company with hundreds of home care workers and even more regular clients. We had offers from private investors, but the best offer came from a gentleman who owned a registered nursing business. The motivation for acquiring this business was to expand into another area that he wasn't in, which was non-medical home health aides. Having both companies would allow him to cross-sell each company's current customer base with the synergies between the combined firms.

- Physical Therapy and Alternative Therapies Practice. This business provides PT, chiropractic, massage therapy, and acupuncture. The seller was ready to retire. We spoke with potential buyers, and the best offer came from a Physician who had his own practice and wanted to diversify and provide more services to more patients. He could refer patients between the two practices.

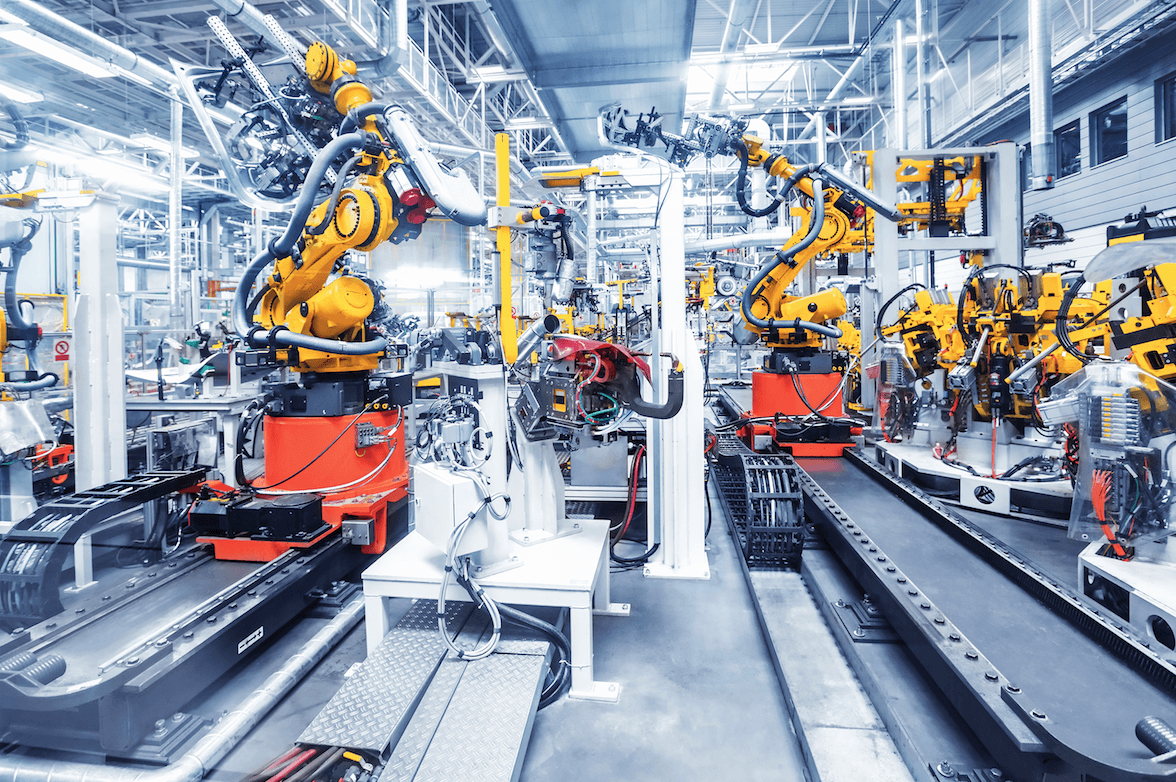

Manufacturing

Contrary to some articles in the press, we have found that US Manufacturing is alive and well. In many areas, US Manufacturing has been growing both revenue and profits. When owners of manufacturing businesses are ready to retire, we continue to see significant interest from potential buyers.

We focus on manufacturing firms with annual net incomes (including owners' salaries and benefits) of $250,000 to $7 Million+. We can always expect a large number of potential buyers for these businesses. The potential buyers are usually private equity firms, other manufacturing firms, wealthy entrepreneurs, and companies that want to get into a niche manufacturing segment that the client is in.

Often, they can leverage what our client firm is manufacturing to grow the business geographically and through new distribution channels. In some cases, they are also able to streamline the company with modern technology.

We have M&A Advisors with experience selling the following types of manufacturing firms:

- Consumer Products Manufacturing

- Industrial Products Manufacturing

- Construction Products Manufacturing

- Food Production & Manufacturing

- Tool & Die Manufacturers

- Raw Materials Manufacturing & Fabrication such as Glass, Metal, Concrete, Plastic and more

- High Tech Products Manufacturing

- Security Products Manufacturing

- Niche Manufacturers

If you are interested in acquiring a Manufacturing Company, please view our current: Manufacturing Businesses for Sale.

An Example of two manufacturing businesses we sold are:

- Our client manufactured and distributed custom architectural glass to contractors and construction companies. The products were used in both residential and commercial buildings. They had a 12,000 sq. ft. facility and also owned the real estate. We marketed the business to many other manufacturing firms as well as construction companies. The best offer came from an individual buyer in his late 30s. He had worked for a private investment firm and had accumulated his own money, and was now striking out on his own to develop his own investment firm. This was his first investment. He was able to purchase the business and real estate from his funds without any bank financing or seller financing.

- Our client is a Specialty Food Manufacturing & Distribution Business in the Capital Region of NY that sold to Supermarkets and other Food Retailers. The buyer who made the winning offers was a food manufacturer and distributor in the Rochester, NY, area interested in expanding its footprint. This acquisition enabled them to cross-sell each other customers with their own unique products, bringing more value to their customer relationships. The combined two companies should be able to increase profit beyond the total of the two companies separately.

Construction

Our sale of construction companies has dramatically increased in the last few years. As we continue to sell more construction companies in given specialty areas, we get more referrals from buyers and sellers, leading to more assignments and more closed businesses. Also, as the economy continues to grow, more construction companies are doing well, which is the market area that we focus on with profitable construction companies in the lower middle market, with revenues of $700,000 to $50 Million+.

We've sold a wide variety of businesses within the construction industry, including:

HVAC/Mechanical

- Home Improvement

- Engineering

- Interior Design & Build

- Concrete Foundations and Paving

- Land Surveying

- Environmental Assessments & Remediation

- Kitchen & Bath Design & Build

- General Contracting Design & Build

- Building Materials Suppliers

- Construction Products Suppliers

- Interior Fabrics

- Excavation

- Tank Removals & Replacement

As with all of our assignments, we keep an open mind as to the buyer because sometimes the winning bidder comes from within the construction industry and sometimes from outside the industry. Here are two examples of construction deals we've closed:

- Land Surveyor Business in NYC that was in business for over 100 years. The current owners were of retirement age and contacted us to help them. With Surveyor businesses, the buyer would need to be a licensed surveyor, so it narrowed the field of potential buyers. We had two Surveyor firms that were both very interested. However, one firm quickly made a full-price offer while the other firm wanted more information. The sellers decided to accept the full-price offer rather than spend time waiting to see what the other buyer would do. The winning buyer owned a Surveyor company on Long Island, and he was interested in breaking into the NYC market. The NYC firm had all the Manhattan area records and a large base of referrals that they had built up over 100 years.

- Heating, Ventilation, and Air Conditioning (HVAC) company located in Connecticut. The seller was ready to retire and move back to his country of origin overseas. He was motivated to move quickly. We introduced a buyer in his local area who owned an IT Consulting Company and an Oil Delivery company that also did some HVAC work. He was interested in expanding his HVAC work and saw this company's acquisition as the best way to accomplish that. He moved quickly, and the business sold in less than 3 months from the time we started selling the business.

If you are interested in acquiring a Construction Business, please view our Construction Companies for Sale.

Wholesale/Distribution

Most of the Wholesale Distribution companies we sell tend to be regional distribution companies. These are attractive to potential buyers because the ones that end up purchasing a particular distribution business typically see an opportunity to grow the business by expanding their customer base both geographically and market penetration to customers within their current geography. These buyers may already have distribution channels where they can add new product lines and/or have the knowledge, contacts, and experience to expand the distribution network.

Some distributors are also manufacturers, and many distributors have supplier's products that they resell. The number of suppliers they have can vary, and access to their suppliers can also be a selling point.

Here are two profiles of wholesale/distribution businesses that we have sold:

- Import & Distribution Company imports goods primarily from China and sells them to retail stores in the US. They sold mainly consumer goods, including travel kits, packaging tools, cosmetics, electronics, clothing, and more. One concern potential buyers had was that 60% of their revenue came from 3 customers. Some other distribution companies were interested, but the best offer came from two partners who had been friends for a while. One of the partners had sales experience and felt that he could grow the business by proactively opening up new accounts. The other partner was supplying the funds and overall business knowledge. They offered full price and had bank financing in place.

- Chemical & Mineral Distribution Company. They had many products that they sourced from within the US and overseas. They distributed products such as paint, paper, cosmetics, plastic, rubber, agriculture, and pharmaceuticals to industrial users within industries. The company owner had tried to sell the company unsuccessfully with another Broker they had used for over a year. We were able to locate many potential buyers successfully. The winning bid came from an investment firm headquartered in Hong Kong that had financial assets of over $500 Million. They preferred to use some financing; however, we introduced a local bank that we had a relationship with that supplied the funding with a 20% down payment.

We have sold distribution companies in the following areas:

- Chemicals Distribution

- Metals Distribution

- Consumer Goods Distribution

- Cosmetics Distribution

- Security Equipment Distribution

- Construction Products Distribution

- Raw Materials Distribution

- Media Distribution

- High Tech Distribution

- Food Distribution

To see our current distribution companies for sale, visit Distribution Businesses for sale.

Professional Services

Professional Services is a diverse group of business types that typically draw a different set of potential buyers for a given subcategory of professional services. We have had experience selling the following types of professional services businesses: Consulting, Staffing, Marketing, Web Design, environmental services, Engineering, Surveying, Security, Insurance, Publishing, and more.

With many of these types of businesses, a specific license or skill set is required, so it helps to have experience selling this particular type of business so that we have a pool of buyers to draw from right from the start of our assignment. This, combined with our advertising and marketing campaign, allows us to get the right buyers for each specific niche of Professional Services.

Here are two examples of Professional Services Businesses that we have sold:

- Marketing & Management Consulting firm. High-profile firm within the digital marketing industry as well as conventional marketing with Blue Chip clients. The owner's name was well associated with the company's brand name, so he knew he would need to stay on and provide a transition for any buyer. Although we had potential buyers within the marketing industry, the most attractive offer was an offer from a wealthy individual who purchased half of the business at a full-price valuation. He was going to have his sons run the business. One had experience in marketing, and the other was an attorney. The seller would have the option of selling the remaining 50% at a later time.

- Insurance Brokerage firm in New Jersey. Private insurance companies attract many potential buyers within the industry. There is a large pool of insurance companies that want to expand their business. The nature of the insurance business is that once a customer is with them, they tend to stay with them, which is attractive to buyers of insurance companies. We received several offers and were able to sell the business at a higher multiple of earnings than the average business sale.

Transportation

The transportation industry sectors can have very different types of buyers that would be interested in their business. Some of the different kinds of transportation businesses that we have interested buyers for are:

- Trucking

- Medical Transportation including:

- Ambulance (Emergency Medical)

- Ambulette (Non-Emergency Medical)

- Junk Pick up & Removal

- Moving

- Limousine

- Taxi

- Vehicle Rentals

- Vehicle Parts

To view our current Transportation Companies for sale, visit Transportation Businesses for sale.

Contractors

Contractors and Construction have a lot of crossover within these two segments. There are a lot of contractors within the construction industry. Some of them are not involved in construction. Some of the ones that we have had success in selling are Landscaping, Energy Efficiency Auditing, and home improvement contractors. Some of these contractors, including landscaping, get involved in new construction, so it varies depending on the contractor.

Below are two examples of Contractor Businesses that we have sold:

- Landscaping Business. The seller wanted to retire and had previously hired another business broker who could not get them the price they were looking for. We introduced multiple potential buyers, including some large Landscaping businesses that were looking to expand through acquisition. However, the best offer that was acceptable to the owner came from an individual from Pennsylvania who did not have experience in Landscaping but was interested in moving back to New York and buying a business near where he was from. We arranged bank financing, so the seller only had to provide 10% of the price in seller financing. 90% of the price was paid at the closing, with the bank providing 70% of the price and the buyer 20%.

- Energy Conservation, Certification & Analysis business in Massachusetts. They analyzed how to effectively reduce energy costs with testing, building code verification, and certification services, including LEED certifications, Energy Star, Green Building requirements, thermal imaging analysis, and more. They also provided services to architects, general contractors, remodelers, HVAC contractors, and homeowners. We set up meetings with multiple potential buyers, and the best offer came in slightly under the asking price. The buyer was motivated, so he was willing to raise his proposal to the full asking price and was able to get SBA financing for the purchase.

Engineering

Engineering is another category that could go under Construction or Professional Services; however, we have decided to have it be a category itself due to our success in selling Engineering Firms.

When selling an engineering firm, the buyer must be either a licensed engineer or another company that acquires the engineering firm. However, the acquiring firm does not necessarily need to be only an engineering firm. We have sold Engineering firms to Construction Companies as well as Architectural companies.

Although we have had a lot of interest from individual engineers who don't own a business and want to acquire one, so far, we have not had any that is the highest bidder. It has always been another company that has acquired and merged the engineering firm into an existing company.

Whenever an engineering firm has been acquired, it is always vital for the seller to stay on after the sale to help with a transition with the customers and employees. Their knowledge of the projects and work to be done is invaluable in the transition. The length of the transition has varied from a few months to many years, depending on the buyer and seller's interest.

Here are two examples of engineering firms that we have sold:

- Engineering Business in Bergen County, NJ(AAES Engineering, Inc.) The majority owner of this business was in his 60s and ready to transition into retirement, and the minority partner was 50 and wanted to work for another 10 to 15 years. He couldn't afford to buy the majority owner's share, so they agreed that it would be best to have a buyer who would retain the services of the minority partner. We introduced several potential buyers who could agree to this and received multiple offers on the business. The best offer came from a large construction company with numerous offices that wanted to expand its engineering services capacity. The buyers provided an employment agreement for the minority partner with terms that satisfied all parties.

- Civil Engineering Business in Suffolk County(Savik & Murray LLP). The Owner was in his 60s and ready to transition into retirement. We were able to identify and introduce several potential buyers and received multiple offers on the business. The top offer came from an Architectural firm seeking to expand by providing engineering services. The architectural firm would also be able to increase its footprint with the addition of an office in Suffolk County, where it had an existing client base. We were able to negotiate terms that satisfied both parties.

Education

When most people think of education, they think of the types of schools that we went to, from Kindergarten to High School and College.

When we think of Education businesses, we think of something different. Our experience in the education business has been in selling preschools/daycares, driving schools, tutoring, supplemental child education, test preparation, adult education, educational camps, and niche education businesses.

Examples of two education businesses we have sold are:

- Educational Franchise for Kids. A company that offers a variety of educational programs for kids ages under a year old to 8-year-olds. Their goals are to ignite children’s passion for education. They also have educational camps and other opportunities to combine Fun & Learning. With our experience in selling educational businesses, we were able to get multiple potential buyers for this business opportunity and, as a result, were able to get the full asking price for the seller.

- Day Care & Preschool Business & Property. A business that provides daycare for children ages six months to 10 years old. They offer child development programs and education classes. The owner was ready to retire, and we found a buyer who would show the same care that the owner had for the business. The owner will stay to help the new owner learn the business.

Summary of M&A Industry Experience

We hope this document has given you a better understanding of our experience in a variety of industries. This list doesn't include all of our expertise. It's designed to highlight some of our areas of expertise.

We focus on selling profitable businesses with an owner's net income (including the owner's salary and benefits of $250,000 to $15 Million. If you have a company in that range you are considering selling, we offer a free, confidential consultation. Please fill out our Seller Registration, and one of our Senior Advisors will contact you. Please view our overview video at Synergy Business Brokers on Youtube.

There is no fee until your business is sold. We'll talk to you more about your business and goals, let you know if it's something we think we can help you with, and tell you more about our process. Since we don't charge a fee unless the business is sold, we only take on assignments that we think we can be successful with.

Feel free to call us at (888) 750-5950 or email us at info@synergybb.com. We look forward to hearing from you.

View our Businesses for sale based on industry

If you are interested in purchasing a business, please view our businesses for sale based on industry. We provide an overview of each business for sale without the name of the business. Since all of our businesses for sale are confidential, to get the details, you would need to fill out our electronic NDA on whichever business is of interest and provide us with some information on your qualifications. Then, a broker will follow up with you.