Jump to Section:

Buying a business can be a complicated procedure, from finding the right one to negotiating terms and working out all the details required for a smooth transfer of ownership.

Synergy Business Brokers has helped Business Buyers and Sellers navigate the business sale process for over 20 years. We have different types of Businesses for sale across price ranges, industries, and locations. Below is some information that may be helpful as you consider which business might be right for you.

Identifying your strengths and interests

The first step is to identify your strengths, interests, and financial capabilities to buy a business. Then, you determine what geographic areas and industries you are interested in purchasing a business. This will help you in determining which businesses for sale might be of interest.

View Businesses for Sale

View our Businesses for Sale based on industry, price, location, keyword search, and more.

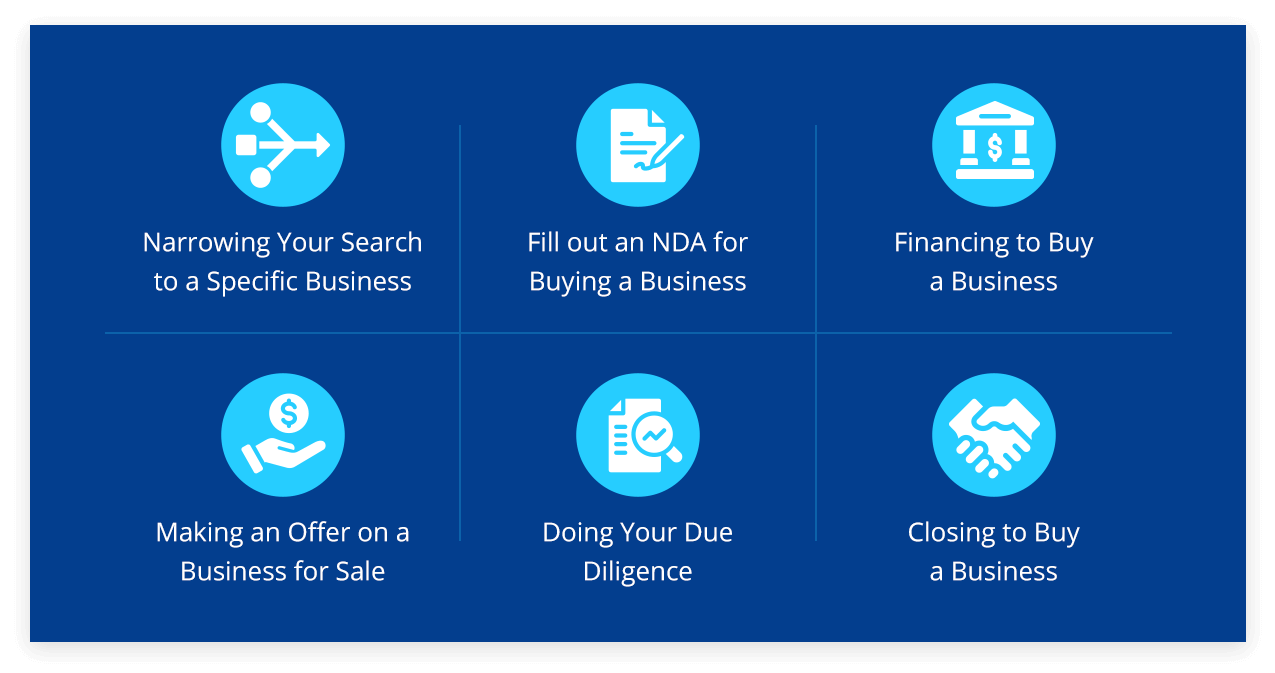

Fill out an NDA For Buying A Business

When you have found a business you would like to get more information on, please click on the Non-Disclosure Agreement on the listing of interest. Once you've filled out the NDA and Buyer Registration Information, a Broker will follow up with you. Please keep in mind that confidentiality is essential to all of the sellers we represent. They want to limit the information provided to people who are financially qualified to buy their business.

View Companies for sale based on State

To view based on location, please click on the state of interest.

Viewing Businesses for sale based on industry

To see companies for sale based on industry, please click on the industry or sector of interest:

View Companies for sale based on price, region, and other factors

Narrowing your search to a specific business

You can consider the business's strengths and weaknesses and how your skills and interests would improve and grow a particular company. If it seems like a good fit, the next step would be to speak with the broker who has the listing of interest and discuss the business and your background further to see if it's worthwhile to set up a meeting or phone conversation with the company's owner.

Financing to Buy A Business

We can connect you with several banks to ensure that you can qualify for a loan to buy a business of interest. In many cases, we supply the bank with information on the company, and you just need to fill out an application to determine what you can qualify for. Some business owners may be willing to provide seller financing for part of the purchase price.

Making An Offer On A Business For Sale

After you understand your financing options and speak with the business owner to get your questions answered, it's time to consider whether you want to make an offer for the company. A business broker can help you draft a letter of intent that outlines the price and terms on which you are proposing to purchase a business.

Once you sign the letter of intent, the business owner will review it and see if it is acceptable or if they will make a counteroffer. If the offer is not in the ballpark, sometimes the owner will decline the offer without making a counteroffer. If you are serious about the business, it's best to make a reasonable offer for it to be considered.

Due Diligence

If the terms of an offer letter are agreeable, both parties will sign it, and the next phase is to move to due diligence. You will verify more information about the business, including financial statements, tax returns, balance sheets, intellectual property, customer base, and contracts, to determine whether to move to the next step: having an attorney negotiate a purchase and sale agreement.

Closing to Buy A Business

When the attorneys finish negotiating the purchase agreement, it's time to set a closing date and start the next chapter in ownership of your new business. Not to worry; the seller typically helps the buyer learn about the business, including its customers, employees, products, services, etc.